fresh start initiative expires

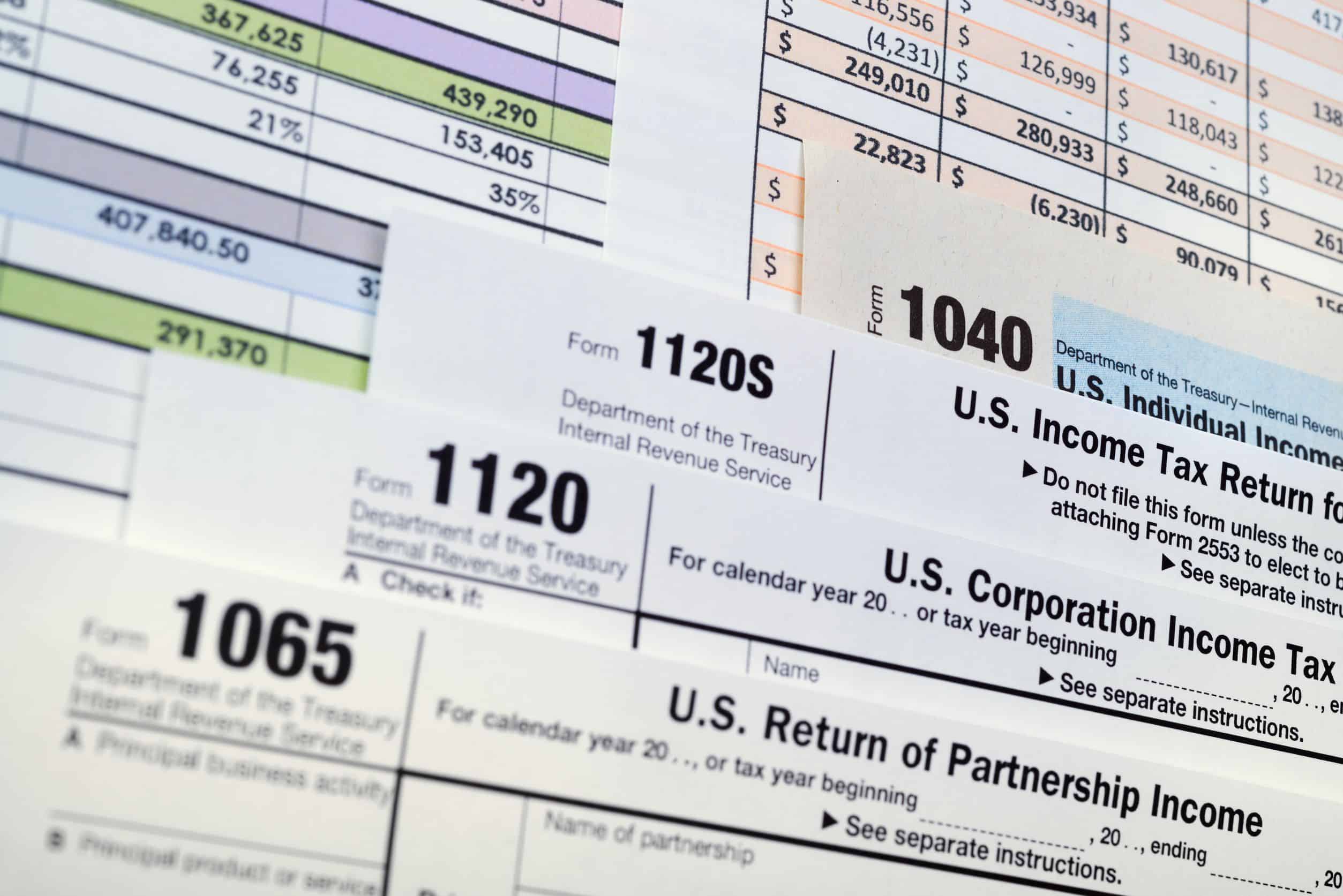

Raising the installment agreement threshold from 25000 to 50000 so long as the debt can be paid within six years. This expansion included the following changes.

Bankruptcy Fresh Start Program The What And Why Day One Credit

Learn about the different programs you qualify for and lower your debt obligation with the IRS - 100 free consultation.

. In 2012 the IRS made some changes to the Fresh Start Initiative in order to make it more accessible for struggling taxpayers. IRS Installment Agreements. The IRS began the Fresh Start.

The IRS Fresh Start Initiative Program could be the answer. The coronavirus has impacted many individuals and businesses. However as part of the Fresh Start Initiative the IRS now allows for equity in dissipated assets to be excluded in the reasonable collection potential calculations when it can.

It is important to understand that when you call the IRS directly you will talk to a. Now with the Fresh Start program taxpayers can pay off their tax debts through the different IRS-approved installment plans. IRS Fresh Start Installment Agreements Generally if you owe less than 50000 to the IRS you can get into a repayment agreement by providing.

The 72 month Fresh Start installment agreement must pay all tax periods within the statute. IRS Fresh Start Program Guide With 2021 Updates. - Learn about the IRS Fresh Start Initiative Helping individuals and small business taxpayers get a Fresh Start with their tax liabilities including changes to Collection policy for.

IRS Fresh Start Program 2. The Fresh Start IRS initiative works by providing a way to settle your debt and avoid penalties. Under the Fresh Start Program the IRS made a change to the manner in which it calculated the Offer in Compromise Doubt as to Collectability.

As a result of the program the dollar criteria for. Launched at the Smithfield Show in December 2004 by Sir Don Curry the Fresh Start initiative aims to secure sustainable future for farming in England by. Check out our Resources section for free tax guides forms and more.

Get a free consultation and see if you qualify today. Generally the IRS has 10 years to collect the tax from the date of assessment. However in some cases the IRS may still file a lien notice on amounts less than 10000.

Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability. The IRS Fresh Start program has also made it easier for taxpayers to qualify for an IRS streamlined installment agreement. The Fresh Start initiative offers taxpayers the following ways to pay their tax debt.

Youll need to submit the appropriate forms and documentation to the IRS to get started. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien. Collecting Taxes takes priority over all your other legal rights once the IRS is ready to move on your assets you may lose your retirement funds paychecks home cars and even your.

The IRS Fresh Start initiative expanded several programs to help taxpayers struggling with unpaid tax debt. The Fresh Start program increased the threshold to qualify for a streamlined. Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues.

The service was established in 2014 and since then has served over 1 million. A Doubt as to Collectability Offer is based on. Thanks to the Fresh Start Program it is now easier for taxpayers to qualify for a streamlined IRS installment agreement.

That amount is now 10000. Here we go through the basics of the IRS Fresh Start Program and where things are at in 2021. What Changes Have Been Made to the Fresh Start Initiative.

Server IP address resolved. Yes Http response code. The IRS began the Fresh Start program in 2011 to help struggling taxpayers.

IRS Fresh Start programs under federal law provide real relief but they can be very complexed to navigate.

What Is The Irs Fresh Start Program 72 Month Installment Agreement

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Irs One Time Forgiveness Program Everything You Need To Know

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Best Tax Relief Services Top 5 Tax Debt Resolution Companies Of 2022

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

The Tax Help Guide Ultimate Resource For Tax Help Questions

The Irs Tax Debt Forgiveness Program Explained

Federal Tax Lien Statute Of Limitations Mccauley Law Offices P C

Bankruptcy Fresh Start Program The What And Why Day One Credit

Toyota Service Parts Coupons Toyota Service Near Tracy Ca

Bankruptcy Fresh Start Program The What And Why Day One Credit

How To Find Csed Irs Wilson Rogers Company

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group